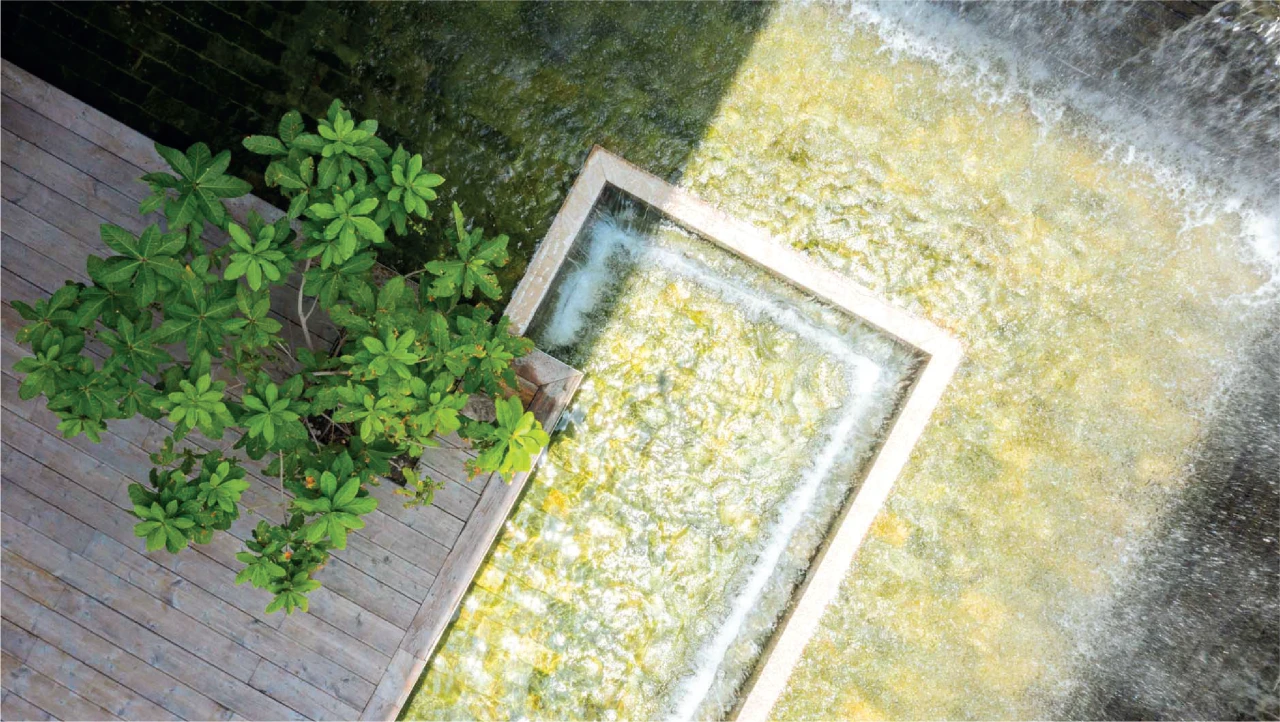

Shahjalal Islami Bank PLC is playing an important role in providing investment in all areas of manufacturing and service sectors, ready-made garments, trade financing, infrastructure and agriculture. Starting operations on 10 May 2001, the bank is running with 12,40,000 deposit and investment customers. As a third generation Islamic Shariah-based private commercial bank of the country, Shahjalal Islami bank plc has reached a strong position within a short span of time and has been playing a worthy role in the economic development. The financial base of this bank is very strong. The bank has currently been providing banking services to its customers with great reputation and trust through 140 branches, 4 sub-branches, hundreds of ATM booths and agent banking outlets, one offshore banking unit and priority centre across the country with 3,000 staffs. It has its iconic 17-storied building with basement on Gulshan Avenue in the capital Dhaka, where the bank’s head office operations are being conducted and being USGBC Lead Gold certified, this building is the first green building in the banking sector in the country. Renowned Architecht Prof. Shamsul Wares has designed the building.

The total deposits of this bank (as on September 2023) is about Tk. 24,421.70 crore and investment amount is Tk. 23,023.45 crore. The amount of import trade in first nine months was Tk 18,982.00 crore and the amount of export trade was about Tk 18,596.00 crore. Shahjalal Islami Bank’s credit rating is AA+ for long term and ST-2 for short term as per Emerging Credit Limited (ECRL) rating. This rating proves that the bank is one of the leading financially strong banks and both customer deposits and investments in this bank are safer and risk free. It has launched Islamic Credit Card following the Wakalah concept of Islamic Shariah. It has 24-hour ATM service and real time online banking and SMS push-pull service. It has agreements with more than 20 of world-renowned remittance companies to provide overseas remittance services, including Western Union, MoneyGram, RIA, Transfast, BRAC Sason, and Al Zaman. Expatriate Bangladeshis can send home hard-earned money, which their relatives can withdraw from any branch of the bank. Moreover, all the branches have facility of online-based utility bill payment. A customer can deposit all types of fees and taxes of Titas Gas, PDB, PalliBidyut, WASA, DPDC, DESCO and BTCL through any branch of Shahjalal Islami Bank PLC. All its branches have e-GP service for respected traders, through which all types of government tenders can be submitted online. No charges are levied for pay orders associated with this e-GP. Shahjalal Islami Bank PLC is working for bringing the people of remote areas under banking services. Thus it is expanding branches and sub-branches. The bank wants to deliver everyday financial services and products easily to the doorsteps of common people. As part of the financial inclusion programme, it wants to extend banking services to all sections of the society. The bank’s remarkable number of agent banking outlets and ATM booths set up in different parts of the country are providing 24/7 cash services. The board of directors of the bank is comprised of professionally competent persons who can formulate policies and guidelines and supervise business and ensure good governance in the banking sector.

The Managing Director and CEO of the bank, Mr. Mosleh Uddin Ahmed, said, “Our goal is to provide welfare banking services to all the people. Profit making is not the main objective. For this purpose, Shahjalal Islami Bank Foundation has been established in consideration of social responsibility, through which this bank provides free medical treatment to helpless and poor people, distributes food and relief items in cyclone and flood-affected areas, provides scholarships to meritorious and poor students and other humanitarian aid. It is trying to spread light of education, public welfare activities, providing scholarships to 600 poor meritorious students studying at higher secondary and graduation level.” “We firmly believe if every financial and business institution spends even a fraction of their profits on improving education of children from poor families, we will definitely have a well-educated and skilled nation. Moreover, cooperation in the development of sports, social and cultural development is being provided as well. Shahjalal Islami Bank PLC provides free Hajj guides, umbrellas and bags to Pilgrims every year and provides bus service for Hajis from Haji camp to Airport.”

National and International recognitions and awards

Shahjalal Islami Bank PLC has received several national and international recognitions/awards in recent years for its excellent and cordial customer services. It has received the award as a recognition of success for achieving a satisfactory position in the sustainable rating by Bangladesh Bank. On 29 August 2023, The bank’s MD and CEO received the award from the central bank Governor. The Bangladesh Institute of Bank Management (BIBM) awarded Shahjalal Islami Bank PLC for Sustainable Rating 2023. The bank won the Gold Award (First Prize) at the 9th ICSB National Award for Corporate Governance Excellence-2021 for best presented annual report 2021. The award was given for ensuring sound corporate governance, discipline and transparency and accountability in the overall management of the bank.

Institute of Chartered Secretaries of Bangladesh (ICSB) awarded Gold Award to this bank in Private Commercial Bank (Islamic Operation) category on 2022. Also, it won the 1st Prize in the 22nd ICAB National Award for best presented annual report. Shahjalal Islami Bank PLC won the first prize (Gold) in “ICMAB Best Corporate Award-2021” for best presented annual report of 2021. The Institute of Cost and Management Accountants of Bangladesh (ICMAB) awarded Gold Award to Shahjalal Islami Bank PLC as the 1st place in Private Commercial Bank (Islamic Operations) category on 2022. The bank has won awards in three categories from South Asian Federation of Accountants (SAFA) for best presented annual report of 2020. The bank won the first runner-up award in the Private Sector Banking Institutions category, the joint first runner-up award in the SAARC Anniversary Award for Corporate Governance category and the second runner-up award in the overall category. The bank is constantly working to upgrade its banking services to global standards. It is working to create industrial establishments, labour-intensive industrial establishments, production-oriented establishments in various regions and also to create employment.

Interest in investing more in ceramic sector

Managing Director and CEO Mr. Mosleh Uddin Ahmed said, “The Ceramic sector is an emerging potential business sector. There was a time when Bangladesh used to import ceramic products from different countries, but in recent years, world class ceramic products are being manufactured in Bangladesh. The Ceramic industry has flourished immensely and has also gained recognition throughout the world of its contemporary eye catching design. Bangladesh is able to export these ceramic products to different countries by fulfilling local needs. Quality of the products has helped Bangladesh to carve the global market. I think the government should extend proper help and cooperation for further development of this sector. I hope within a short span of time the Ceramic Industry would become one of the biggest foreign exchange earners.” “Shahjalal Islami Bank PLC is highly interested to invest more for sustainable development of ceramic sector in near future. In this regard we seek Bangladesh Ceramic Manufacturers and Exporters Association’s proper help and cooperation.”

Written by Lamia Mehreen