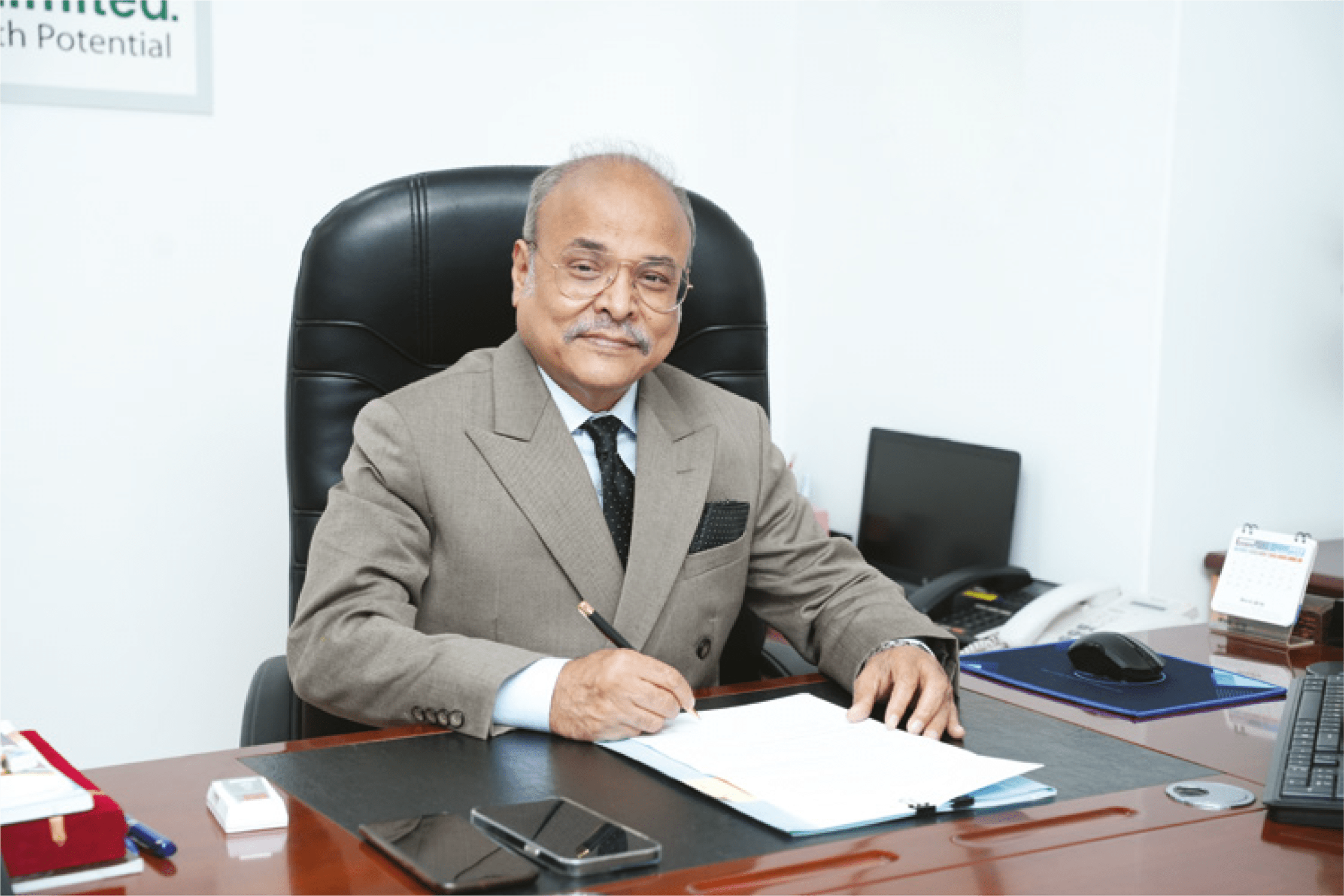

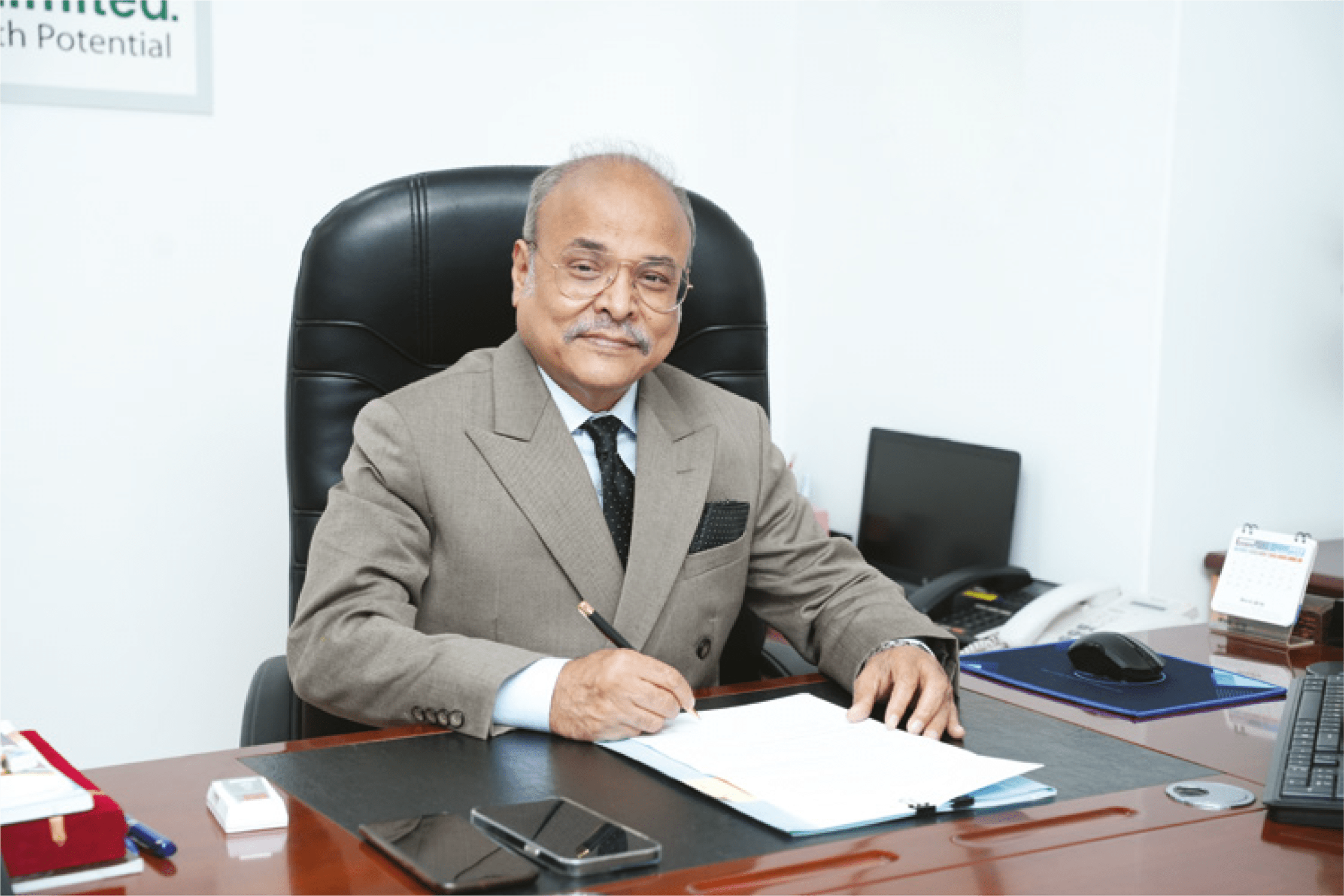

National Bank Limited (NBL) Deputy Managing Director Hossain Akhtar Chowdhury tells with Ceramic Bangladesh an exclusive interview that the ceramic sector needs a huge investment in the future.

Hossa Akht Chowdhy

Deputy Managing Director, NBL

Ceramic Bangladesh (CB): Would you please tell us about your bank – What is the prime catalyst for its rise?

Hossain Akhtar Chowdhury (HAC): National Bank Limited (NBL) was born as the first 100 percent Bangladeshi entrepreneurs-owned bank in the private sector. The first branch at Dilkusha Commercial Area of Dhaka started commercial operation on March 23, 1983. The 2nd branch was opened on May 11, 1983 at Khatungonj, Chittagong.

The then President of Bangladesh Justice AFM Ahsanuddin Chowdhury inaugurated the bank formally on March 28, 1983 Basically, the bank has flourished through building trust among people. The expectation of all class businessmen, entrepreneurs, and the general public is high to NBL. At present, we have 221 branches and 33 sub branches. In addition, our effective and diversified approach to seizing market opportunities is going on a continuous process to accommodate new customers by developing and expanding rural, SME financing and offshore banking facilities. Since the very beginning, the bank has exerted much emphasis on overseas operations and handled a sizable quantum of homebound foreign remittances. It has drawing arrangements with 415 correspondents in 75 countries and with 37 overseas Exchange Companies located in 13 countries. NBL has focused on all key areas covering capital adequacy, maintaining good asset quality, sound management, satisfactory earnings, and liquidity. CB: What services does the bank provide to its customers at present?

HAC: As a leading commercial private bank, we provide all required services. We have Corporate, Retail, SME, and Global Banking, Ancillary service, Treasury service, and credit card too. We are one of the first 10 banks who collect remittances. We have our own Exchange Company in Malaysia, Singapore, Greece, Maldives, and Oman. Besides, we have good relations with many exchange companies across the world. We are prioritising on remittances and Trade finance from NBL inception as well. We started using Master Card and credit cards at first in the country when people were unaware in this regard. Even, we started here back-to-back L/C opening in garments sector for the first time when people didn’t know what it was. We are proud of it. Now the garment sector is leading as export earnings. CB: What type of facilities do you provide to local manufacturing industries?

HAC: Manufacturing sector is very important for a developing country Hossa Akht Chowdh y Deputy Managing Director, NBL A BCMEA REPORT but we have no separate project or product for this sector. Even it is not in other bank. But it should be in front. We are a developing country. Bangladesh will graduate from LDC by 2026 so it is more important for us. We should pay consultation in the manufacturing industry. Though we have a giant part of our loan here.

CB: As the ceramic industry is a fast growing sector, do you think it will provide better facilities for the manufacturers? HAC: The Ceramic industry of Bangladesh is the oldest industry. Pakistan Ceramic Industry (PCI) was set up in Tongi area in 1960. It was an important one for export. Now we see huge ceramic products made in Bangladesh, when I visit different countries, which are very nice products.

Our engagement with ceramic manufacturers did not strengthen because of both sides’ inattention. There is a huge potential for the ceramic sector in future. We will go forward to them if we can build our relationship properly. Big investment is needed for ceramic manufacturing. So, new investment is fewer here. We are ready to give loan to good people if we can reach a proper negotiation.

CB: What is your observation on the country’s banking sector? HAC: Banking is a place of trust. Some media focused that the banking sector of Bangladesh has been devastated. Actually all media reports on banking sector are not true. No bank did fail in the history of Bangladesh. But liquidity crisis has been there in the market that is true. There is some lack of regulation and compliance issues. But the banking sector will not extinguish. There are some temporary problems. But the banking sector is in good position now. CB: What challenges do you face now and how can these be overcome either? HAC: Now the major problem is liquidity crisis in banking sector. Foreign exchange crisis is also here as its availability is sparse.

Bangladesh had to import more compared to export. So a big gap has been created in the banking sector. We tried to reduce imports to resolve the problem. Letter of Credit (L/C) opening problem arose due to shortage of foreign currencies. There is a global crisis too due to Russia-Ukraine war after the Covid-19 pandemic. Besides, Bangladesh government implements huge development projects like Padma Bridge, flyovers, road and others. So, huge raw materials and other products have been imported. As a result, the country’s reserve has shrunk. To overcome the current situation of the banking sector, bankers must be prudent on loan disbursement and loan monitoring. We have to work neutrally. Actually, professionalism must be developed to resolve the problems.

CB: What issues do you prioritise when clients come to your bank for taking loan? HAC: We observe three issues such as business, person and security. We don’t give loan seeing land. We give loan for doing business. We observe what potential of the business is. We analyse person – if he/she is honest or dishonest. Whether, the person can return loan. What is his habit? Thirdly, we see security issue. Whether, the client is habitual loan defaulter. Or how much his financial capacity is.

CB: What is your suggestion? HAC: As Bangladesh is a free economy, the interest cap should be withdrawn. I think 6-9 per cent interest is a crisis in the high inflation country. IMF also called for withdrawing interest cap. We are observing the matter. Then, we will give loan based on the industry’s priority. Investment should not be made in sick industries. However, we all should pay attention to compliance.

CB: Do you look for government policy support now? HAC: Bangladesh’s economy is boosting vastly. The government should not make such a policy which impacts the banking business. Bangladesh Bank should monitor effectively to develop the sector. Technology must be developed to sustain in the world. Those banks will perform better which can adapt with modern technology properly. CB: What is NBL’s future plan? HAC: Around 70-80 million people are out of banking services in the country yet. We want to reach out for services at the village level. We also want to perform better in remittance collection.