The proposals put forward by Petrobangla companies to the Bangladesh Energy Regulatory Commission (BERC) for a 117 per cent increase in the price of natural gas supplied to various categories of subscribers on the plea of the LNG price spiral in the spot market. As a statutory body, the BERC is mandated to determine fuel and electricity tariffs considering all aspects of price structure, efficiencies of different actors and protecting the interest of consumers. In the backdrop of executive authority in administering energy prices different stakeholders have emphasized a fully functional BERC. Because everybody knows BERC is not an extension of bureaucracy of the government.

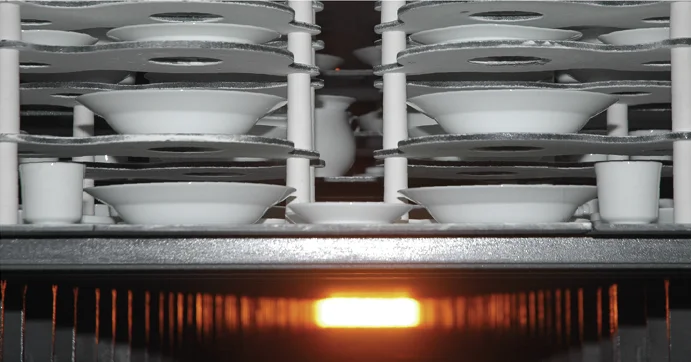

The recent price hike proposal has been tabled at a time when, amidst the Covid-19 pandemic, users of gas – industrial, commercial and domestic – are suffering from chronic shortage of gas supply. The President of Bangladesh Ceramic Manufacturers and Exporters Association (BCMEA) Md. Shirajul Islam Mollah complained about paying for ‘air’ supplied instead of gas. Many domestic users have to use alternate fuel. Gas deficit was there for a long time but from mid-December 2021, RLNG supply came down due to a technical glitch. Petrobangla companies supply 2,850 mmcfd against a coincident peak demand of 4,200-4,300 mmcfd.

Some 78% of the supply comes from local source (Petrobangla companies operated fields and International Oil Companies), 17% from RLNG purchased under long-term contract and only 5% from spot purchase. No change of price has been reportec for 95% of the gas supplied. Only for this 5%, there has been price impact and that too was from a few cargoes purchased at higher price. For this, there is no reason why Petrobangla can submit a proposal for 117% increase of gas price. Petrobangla supply has come down from 2,760 mmcfd to below 2,350 mmcfd. There has been hardly any effective steps by the Petrobangla companies to augment gas production from own fields. Even moves for maintaining production through secondary and tertiary recovery are slow.

We are not mentioning about failure in expediting exploration for gas in onshore frontier areas and offshore. Consequently, proven reserve of gas is fast depleting and many are apprehending that major depletion may trigger from 2023 and local production may even deplete below 2,000 mmcfd. The government has taken steps to import LNG by setting up floating storage and regasification units (FSRUS) in 2010. Under business as usual, such an FSRU usually takes 18-24 months to come into operation. But for Bangladesh, the first one came into operation in 2018 followed by another one in 2019. These two together has a capacity of supplying 1,000 mmcfd. At peak, they supply up to 750-800 mmcfd. Petrobangla after prolonged negotiations with Qatar and Oman could conclude long-term contracts for supplying up to 75-80 per cent of LNG supply. The remaining supply came from spot market. The government could not take advantage of very low LNG spot price during early stages of the pandemic. It has shown lack of experience of price hedging cr future purchase. As such Petrobangla ran into crisis as soon as LNG price at global market skyrocketed.

Poor Sectoral Management and Corruption Added to Crisis

Apart from lack of perspective planning for exploration and development, the Petrobangla companies could not arrest rampant theft and pilferage of gas from hundreds of thousands of illegal connections, illegal use of a section of legal users through meter tampering, and meter bypassing. A section of corrupt officials is engaged in the process. About 8-10 per cent of 300 mmcfd gas allegedly remains unaccounted for, causing revenue losses. This also makes distribution system unsafe as accidents prove. Moreover, Petrobangla and companies have huge overhead expenditures for heavy management. They lack adequate technical persons in boards and this goes against the provisions of Company Act. BERC can police against such irregularities by carrying out technical and management audit. By controlling systems loss, inefficiencies and colossal wastage, it is possible to reduce gas deficit. Even a 50 per cent success could offset the requirements of gas price at this critical stage when Bangladeshi industries are struggling to retain competitiveness.

What BERC Can Do?

It appears that the present catch22 situation with gas price has arisen from about 200 mmcfd LNG import from the global spot market at exorbitantly high price. It is well known that about 200-250 mmcfd gas goes unaccounted for in the distribution system. BERC must advise its gas distribution licensees and Petrobangla to address the issue. BERC should ask Petrobangla to seek NBR for adjusting tax, Vat and import duty of primary fuel. Petrobangla must be advised to ensure that all gas and energy companies are governed strictly in accordance with the relevant act. Offficials who are included in the company boards, cannot claim additional remunerations and benefits.

BAPEX has innovated Gas Development Fund (GDF) out of gas sales proceeds for exploration and development of petroleum resources. BERC should make gas consumers know how and where this fund has been used. Bangladesh has laws, rules and policies for regulating electricity, gas and other utility agencies. BERC should monitor and overview ccmpliance. A well-crafted reporting format with all mandatory requirements can be developed for utilities to prepare and submit to BERC on monthly basis. Based on these reports, BERC can assess the performance of licensees and whenever necessary can carry out auditing. BERC can set key point indicators (KPI) as performance metrics. Among others, system loss and account receivables must feature there.

Roles of Stakeholders in Enhancing Efficiencies

All stakeholders have roles in creating efficiencies and eliminating illegal use of fuel and electricity, and other utility services. Regulators usually retain the right to create provision for licensees for taking permission for making major investments in infrastructure development. If that could be done, many less priority investments and wastage could be avoided. Some over ambitious projects of BAPEX and over investments of GTCL could be avoided if BERC could review these beforehand. BERC should have a team of qualified and trained energy auditors for carrying out audits for ensuring efficiency. Petrobangla and its companies should be made accountable to BERC for appropriate use of proceeds of Gas Development Fund.

BERC should have provisions for stakeholders’ engagements for discussing matters like fuel mix and application of modern technology. Trade bodies like FBCCI, BCMEA, BGMEA and BTMA must assist Petrobangla companies in eliminating gas theft and pilferage.

Conclusion

Prevailing and emerging situation need adjusting gas price but this must be logical. All avenues of efficient use of fuel must be exploited and systems loss and wastage must be eliminated. Over expenditures and corruption must be curbed. These would ease the situation considerably. Investment for enhancing production of own gas by expediting exploration and adjustment of import duties and taxes on fuel import are also necessary. Bangladesh cannot afford becoming an entirely import- dependent country at this stage of gracuation to developing economy.

Written by saleque sufi