Bangladesh’s ceramic industry shows signs of recovery from the global pandemic effects with much higher potential, in terms of both domestic and foreign market demand apart from enthusiasm among and endeavours by the entrepreneurs to see it shining.

However, the ceramic sector growth has slowed since manufacturers cannot deliver products on time owing to disruption or shortage of supply of gas as the key factor of production. Bangladesh’s exports of ceramic products rose to a four-year high in the 2022-23 fiscal year but could not yet match the level of exports recorded in 2018-19 fiscal year, the year before the pandemic struck the country. The country’s export earnings from the ceramic sector stood at $43.39 million, 13.22 per cent lower than the target of $50 million export set for the fiscal year 2022-23. It was still about 5.0 percent higher than the earning year before. The export of ceramic products was $41.36 million in 2021-22, $31.11 million in 2020-21, $27.97 million in 2019-20 and $68.97 million in 2018-19, according to Bangladesh Export Promotion Bureau (EPB).

The country exports ceramic products to 53 countries and the domestic market size of ceramic items is around Tk 80 billion. These figures underline the fact that the country’s ceramics industry has turned into a booming manufacturing sector over the years, cashing in on growing demand both in domestic and international markets. “Manufacturers could not run factories at full capacity due to inadequate supply of gas. This was the main reason the sector did not achieve expected export growth in the last fiscal year,” said Irfan Uddin, General Secretary of the Bangladesh Ceramic Manufacturers and Exporters Association (BCMEA). Also, he added, the demand in the international market has not increased unlike expectations, due to the Ukraine-Russia war. The gas crisis hit industries last year after the government paused purchasing liquefied natural gas directly from the international spot market to stop depletion of foreign currency reserves, leading to a drastic fall in energy supply. Mr Irfan Uddin said manufacturers did not get the gas supply for around 12 hours a day since last October. “So, we could not make products on time. As a result, we were not able to supply goods against around 30 per cent of the orders,” said Irfan Uddin, also Director at FARR Ceramics Ltd. He, however, appreciated the government for providing a 20 percent cash incentive against exports of ceramic products, terming this as encouraging for the ceramic exporters.

M.A. Jabbar, Managing Director at DBL Ceramics, said the business of the ceramic sector is going through a difficult stage due to increase in the production cost and the gas crisis. “Absence of uninterrupted gas and power supply and increase in the cost of production hampered production, ultimately affecting the exports of ceramics,” he argued. The entrepreneur said owing to disruptions in gas and power supply, the sector has faced a big challenge in maintaining quality of products

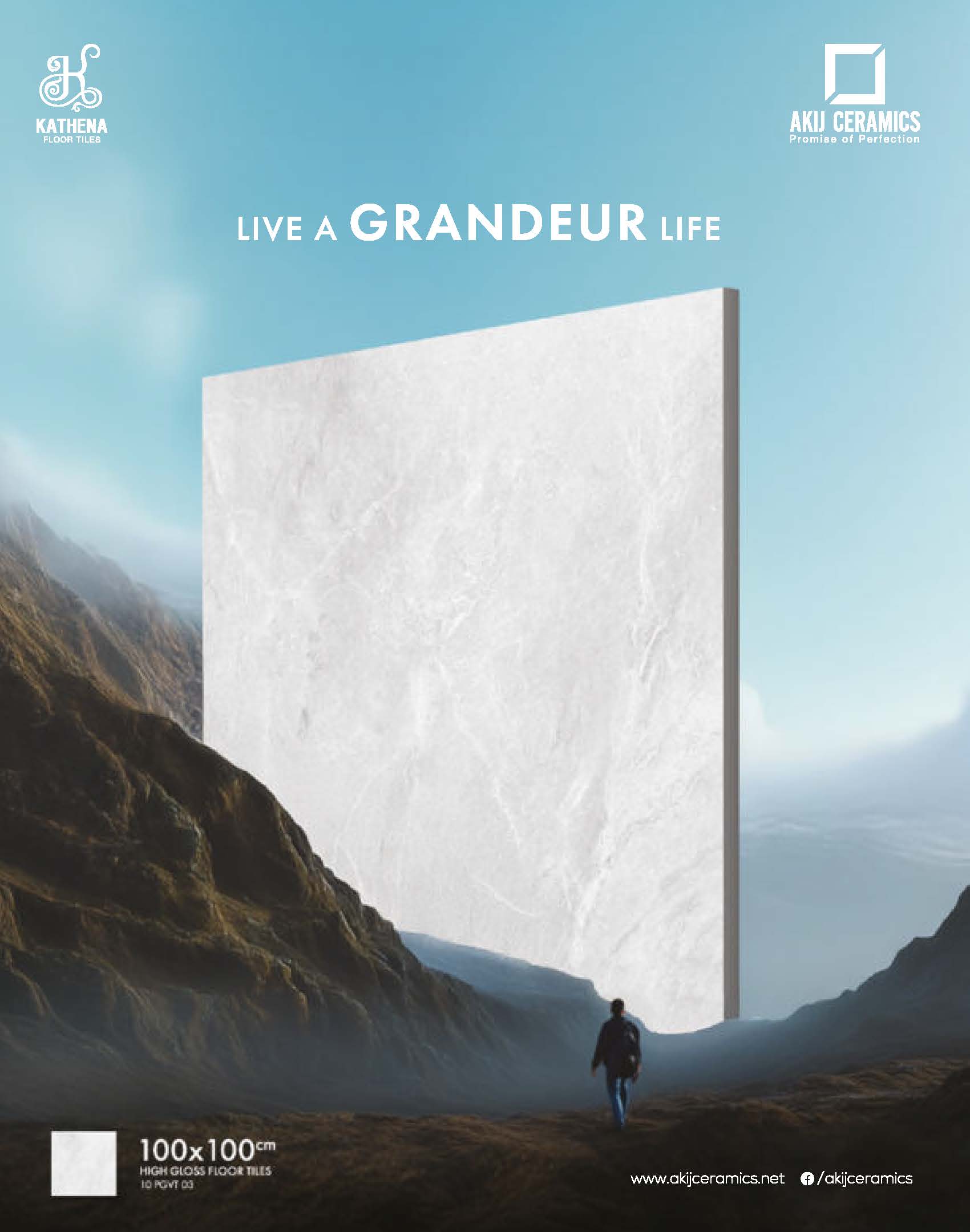

Local ceramic manufacturers mainly produce four types of products: tiles, tableware and sanitaryware and ceramic bricks. Of the 70 manufacturers currently operating, twenty produce tableware, thirty two make tiles and the rest produce sanitaryware and ceramic bricks. Bangladesh mainly ships tableware and has added tiles, sanitaryware & ceramic bricks to the export basket in recent years. According to Mr Jabbar, considering the ongoing high inflation environment, manufacturers are not in a position to raise prices of their products despite an increase in their cost of production. As a result, the profit margin has plunged to the lowest level

Ruslan Nasir, Deputy Managing Director of Mir Ceramic Limited, said tiles manufacturers export on a limited scale and contribute an insignificant amount to the export basket. The company mainly exports to the north-eastern states of India. Ruslan Nasir said local tiles manufacturers are focusing on the local market since demand has grown over the past decade, thanks to rapid urbanisation. “There is a lot of competition in the tiles segment globally. And since the sector is dependent on imported raw materials, it will take time for the local producers to grab a significant share of the international export market.” He, however, sees a bright prospect of the tiles segment since Bangladeshi manufacturers produce world-class products.

BCMEA President Md. Shirajul Islam Mollah said, “At present, two major problems of the ceramic sector are gas and dollar-crisis. It is facing a challenge. We are not getting uninterrupted gas even with increased prices. Most of the factories in the ceramic sector are in Gazipur. Due to the gas crisis, the production of factories here has dropped to 40-50 percent. Again, the gas situation is somewhat better in Bhola and Habiganj, but there is a problem in Narsingdi and Rupganj. Production of most factories is disrupted due to the gas crisis. Overall production is going down by 40 percent due to the gas crisis. So the production cost is also increasing and exports are facing challenges.”

Ceramic manufacturing companies are also facing problems in opening letters of credit (L/Cs) for import of raw materials due to dollar shortage. He said 90 per cent of the raw materials of ceramic products are imported. Meanwhile, the increase in dollar and gas crisis, on the other hand, due to the increase in ship fares, the cost of production has increased by 30-35 per cent. Due to the gas crisis, the tiles could not be produced according to the market demand in the last winter season. It is not possible to use more than 60-70 per cent production capacity of the factory According to the National Board of Revenue (NBR) data, imports of mineral clay — ‘China clay’ and ‘Ball clay’, the main raw materials for ceramic products — fell by 17 per cent in the fiscal year 2022-23. Now, it takes 15 days to open L/Cs for raw material imports compared to only two days for the purpose, due to the dollar crisis. Thus there is a shortage of raw materials in the factories. He said, ‘All in all, the ceramic sector is going through challenges. At present, additional supplementary duty of 15 percent on tiles production and 10 percent on sanitary products needs to be withdrawn to provide relief to entrepreneurs. Apart from this, the exclusion of 35 percent weight due to moisture in imported mineral soil is a long-standing demand.” Written by Lamia Mehreen

He said 90 per cent of the raw materials of ceramic products are imported. Meanwhile, the increase in dollar and gas crisis, on the other hand, due to the increase in ship fares, the cost of production has increased by 30-35 per cent. Due to the gas crisis, the tiles could not be produced according to the market demand in the last winter season. It is not possible to use more than 60-70 per cent production capacity of the factory According to the National Board of Revenue (NBR) data, imports of mineral clay — ‘China clay’ and ‘Ball clay’, the main raw materials for ceramic products — fell by 17 per cent in the fiscal year 2022-23. Now, it takes 15 days to open L/Cs for raw material imports compared to only two days for the purpose, due to the dollar crisis. Thus there is a shortage of raw materials in the factories. He said, ‘All in all, the ceramic sector is going through challenges. At present, additional supplementary duty of 15 percent on tiles production and 10 percent on sanitary products needs to be withdrawn to provide relief to entrepreneurs. Apart from this, the exclusion of 35 percent weight due to moisture in imported mineral soil is a long-standing demand.” Written by Lamia Mehreen