bKash, a mobile financial services (MFS) provider in Bangladesh, is operating as a subsidiary of BRAC Bank Limited, under the authority of Bangladesh Bank. bKash has been providing fast, secure and convenient services via mobile phone to its more than 70 million verified customers for the past 12 years, authorities say. These customers transact more than Tk 20 billion every day.

Only recently, people had to wait in long queues in the morning just to pay utility bills. And almost no financial services could be accessed from home comfortably. However, gone are those days, thanks to MFS providers like bKash. Now, millions of people no longer need to worry about paying bills or fees, doing savings, taking small loans or even receiving remittance from abroad – all these are now a matter of a few taps. MFS has evolved into a common platform for availing various financial services. As a result, the hassles people used to face earlier while seeking financial services are now considered a thing of the past. Financial services have reached the fingertips of people from all strata, making life easier. The dependence on digital transactions thereby increased manifold. It’s not just a means of sending money or paying bills anymore. It has become a complete financial service platform with a variety of financial products including merchant payment, savings, nano loan, remittance from abroad, bill payment and mobile recharge. It has become a part of lifestyle. bKash is now a member of every family in weal and woe. Though some other MFS providers have launched similar services, the term “bKash me” in the MFS arena is now the word of mouth that simply denotes money transfer. In its 12 years journey, according to the authorities, bKash has built the strongest network of 3,30,000 agents, commonly called as “Human ATMs” to take mobile financial services to the doorsteps of people in every corner of the country. These agents have not only succeeded in serving customers, but also been able to improve the living standard of their own families. Other MFS operators who came later, took leverage of this distribution channel established by bKash to reach customers.

Bangladesh Bank, the regulator of this industry, has had proper guidance and policy support to help MFS flourish and become customers’ trusted partner for daily transactions. Besides, bKash’s service quality, continuous investment and innovation played pivotal role in garnering the trust of custromers. Of its 70 million user base, more than 45 per cent customers are female. Customers can avail its services such as cash deposit, cash withdrawal, money transfer, top-up, remittance, mobile recharge, payment and bill pay by dialing *247# and using Bkash app. To open an account a customer has to fill the prescribed customer registration form (KYC) with complete details. If the money goes to the wrong number it should be reported to 16247 immediately. bKash started operating as an MFS provider under the license of Bangladesh Bank on 21 July 2011 to cater financial services through mobile phones. Catering to people’s daily transactional needs with secured and time-saving solutions, bKash is empowering them to fulfil their dreams as well as taking the country forward

During this time, bKash has brought the unbanked and underserved population into financial inclusion. Be it from a remote village or a small village market or a trading centre, a large number of customers has been connected to the formal financial channels through bKash. Currently, a total of 44 commercial banks are connected to the largest bank integration network of bKash. Thanks to seamless money transfer between bKash and banks, customers’ experience has radically changed, the authorities told the Ceramic Bangladesh. Earlier, going to a shop was the only way of recharging mobile phone numbers. In the span of an era, topping up all operators’ mobile numbers through bKash has become the most preferred way for millions of people in Bangladesh.

A mountain of hassles for paying just a small amount of utility bill was a common place before. Now bKash has made all kinds of utility bill payment for electricity, gas and water easier for the common people. Besides, fee payment of many government services has become a matter of a few taps, they said. Since 2017, bKash has successfully disbursed allowances and stipends to around 10 million beneficiaries of many government initiatives and safety net programmes including primary education stipend, the Prime Minister’s Covid-time financial assistance, farmers’ incentive allowance under the Ministries of Agriculture, Fisheries and Livestock, maternity allowance, the Ministry of Disaster Management and also the salary, allowances and incentives of workers of the export-oriented industries. Bangladeshi expatriates from around 90 countries can send remittances through 80 international money transfer organisations via settlement in 17 local commercial banks. In 2022, nearly Tk 40 billion worth of remittance came to Bangladesh through bKash. Savings through bKash has also become very popular among the people. So far, around 1 .1 million customers have availed the savings schemes through bKash app. The hassles to save small amount of money is now gone due to such service. Not only ‘Savings’, digital nano loan can also be availed through bKash app. bKash, in association with The City Bank, introduced the country’s first-ever Digital Nano Loan in 2021. With this innovation, eligible bKash users can avail a loan ranging from Tk 500 to Tk 20,000 through bKash app. In the meantime, digital loan of Tk 3 billion has been given for a period of 3 months.

bKash services save times, relief hassles

Proprietor of M/S Taqwa Ceramics at Hatirpool Mohammad Zahid Hossain said, “Many customers want to make payment now after purchasing ceramic products through bKash as it saves their time and reduce other hassles. At the same time, it saves us from risk of handling counterfeit notes.” The digital transaction in business and other payments is going up day by day. As a result, the demand of bKash services increased as well.

Another trader, Imran Hossain, manager of Ammar Sanitary of Bangla Motor, said they sell different types of tiles and sanitary products. “Many customers make payment through bKash when they have no cash or as alternative of cash while purchasing products. There are no risk of carrying money. Besides, some trusted customers also make payment remotely through bKash and we just make the delivery to that customer’s address in time,” he also said.

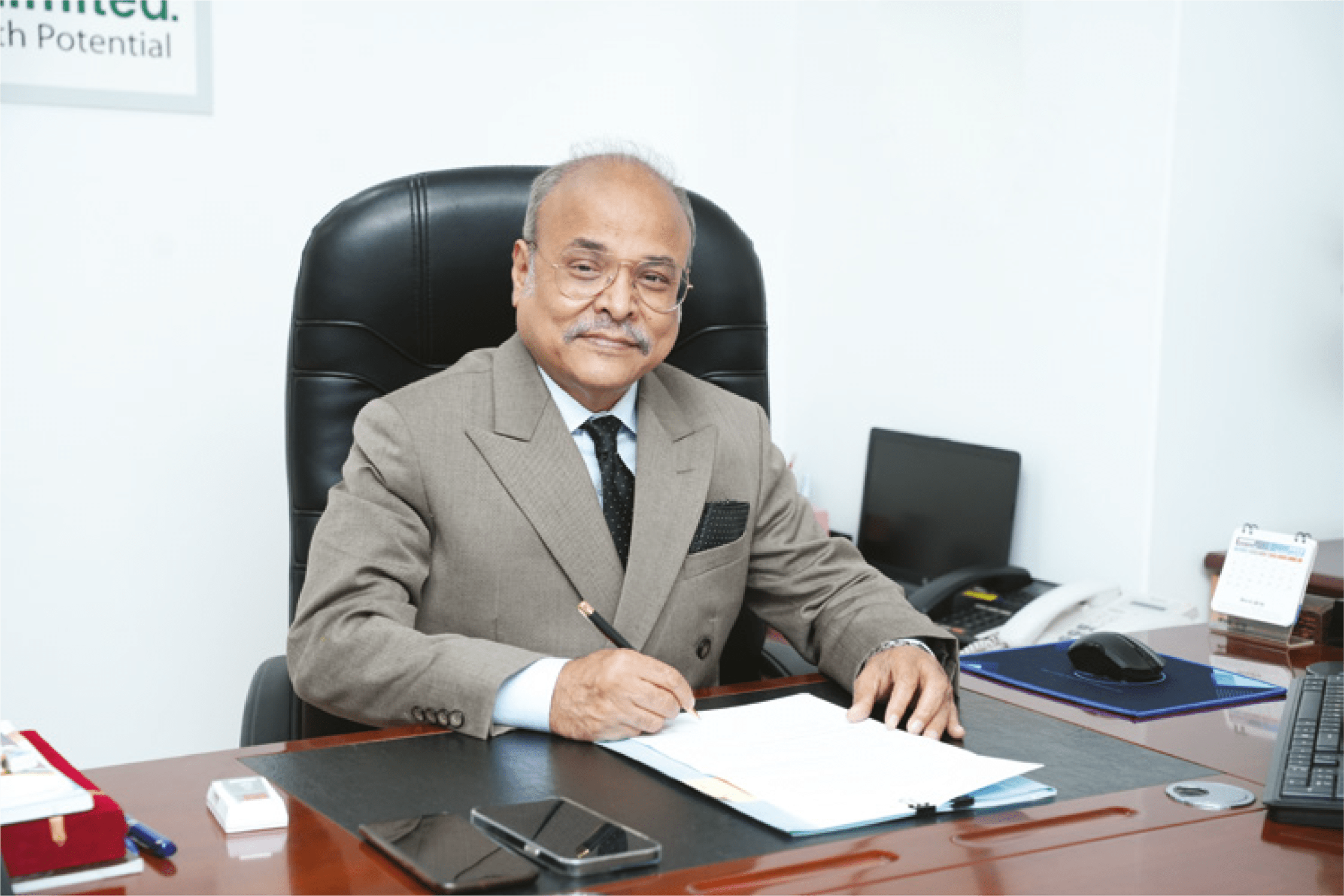

The story of founding bkash

Mr. Kamal Quadir was working one summer at a private equity firm in New York. However, it did not take long to realise that it could not be his real workplace. As a result, he eventually returned to Bangladesh. In 2005, Kamal Quadir created the first online shopping platform “cellbazaar.com”. Then, in 2011, he established the mobile financial services company – bkash. Earlier the middle class used to earn money and save it in the bank, and the bank would use it for development. Now the money of the poorest people has also come in this system, that is also being used for economic development. bkash is the only unicorn in the country, whose market value has crossed $2 billion in one decade. And this has become possible due to the availability of mobile phones. Along with that, there is the empowerment of people who are outside the reach of the bank. However, according to bkash CEO Kamal Quadir, attaining unicorn status or other achievements is not the main story of bkash, but financial inclusion of people is at the core of all bkash activities. From Cell Market to bkash, millions of unbanked people have benefited from his innovative leadership. Kamal Quadir himself had graduated from Oberlin College in the United States with a degree in Arts and Economics. Then in 2003, he did his MBA at MIT (Massachusetts Institute of Technology) in the United States.

bkash is working on the slogan ‘Roots is my homeland, who is stopping my development’. Without traditional branch banking, bkash has built a large network of 3,30,000 agents across the country. They are working as ‘Human ATM’. They convert paper currency into digital currency and digital currency into paper currency. Besides agents, bkash has 5,00,000 merchants across the country. They buy and sell digitally as well as in cash. More importantly, when the country goes fully digital and paper or metal currency is eliminated, corruption will also come down. bkash has become accustomed to Cash-In and Cash-Out. But bkash can be used in more ways to make life easier. This is the goal of bkash now. Currently, 75 per cent of the 12 million transactions per day in bkash are digital transactions. Customers are recharging mobile phones, sending money, payment for purchasing or paying bills through bkash. Out of 70 million customers, more than five million people are now paying for various services and products with bkash

Kamal Quadir

CEO, bKash

every month. So if this habit of digital transactions is being developed further, there will be no need for cash-outs in the near future. Everything will be on payment mode. As a result, there will be no need to cash-out and there will be no cost. Brac Bank has a major investment in bKash (51%). In addition, there are investments from the World Bank Group’s International Finance Corporation (IFC), the US-based Money in Motion LLC, Bill and Melinda Gates Foundation, Alibaba’s Ant Financial or Alipay from China and Japan’s Softbank Vision Fund. bkash has brought about $400 million of foreign investment. So far not a single foreigner had to be appointed in bkash. This is possible because there is no dearth of talent in the country and bkash has become the world’s second largest and fastest growing mobile banking services company. Now bKash is waiting for digital bank.