18th ISSUE

Bangladesh: Asia’s Next Trade Powerhouse

Bangladesh is quietly rewriting its economic story. Once known primarily for its ready-made garments, the country is now emerging as a diversified trade hub in Asia. Its export basket is expanding—and so is its global relevance. Earnings from exports have always been the nation’s driving force, and the last fiscal year was no different. Apparels played a dominant role, earning $48 billion, while other sectors also expanded their global reach. “Bangladesh’s export basket did not widen overnight—it was hard-won,” said Moynul Islam, president of the Bangladesh Ceramic Manufacturers and Exporters Association (BCMEA). “And now Bangladesh is home to a vibrant young population—more active and intelligent than their predecessors,” said Islam, who also serves as vice chairman of Monno Group. “From ceramics to garments, pharmaceuticals to electronics, this generational shift is redefining the business landscape and accelerating new export frontiers, positioning Bangladesh as one of Asia’s most promising investment and trade destinations,” he added. RMG : The Backbone of Bangladesh’s Trade Garments remain Bangladesh’s strongest export pillar, contributing over $39 billion in FY2024-25 knitwear and woven categories combined. Knitwear alone earned $21.1 billion, while woven garments brought in $18.1 billion, according to data from the Export Promotion Bureau (EPB). The sector’s strength lies in its scale and adaptability. Bangladesh retained its position as the world’s second-largest apparel exporter in 2024, as confirmed by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). Exports to non-traditional markets are rising, and shipments to the USA grew by 29 percent between January and April 2025. Yet, the industry faces headwinds. Rising production costs, energy inefficiencies, and compliance pressures are squeezing margins. Extortion in industrial belts and loan defaults among top exporters have also raised concerns, as noted by Bangladesh Bank. To stay competitive, the sector is embracing green manufacturing and automation. Over 260 factories are now LEED-certified, and green factories enjoy tax incentives and higher buyer preference. With continued investment in sustainability and worker welfare, RMG is poised to remain Bangladesh’s trade anchor. Home Textile: The Quiet Climber Once a niche category, home textiles have become Bangladesh’s second-largest textile export segment. The sector continued growing despite global challenges, earning $871 million in the last fiscal year. The rise of wellness living and interior-focused consumption has boosted demand for bed linens, curtains, and towels. Bangladesh’s manufacturers are responding with eco-friendly fabrics and design-led collections. However, the sector remains vulnerable to tariff uncertainties, especially in the US market. To mitigate this, the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) recommends diversifying export destinations and investing in design innovation. With stable growth and rising global demand for sustainable home goods, Bangladesh’s home textile sector is quietly climbing the ranks. Leather and Leathergoods: A Legacy in Transition Bangladesh’s leather sector has shown resilient performance, earning over $1 billion annually since FY2018-19. Once hailed as the country’s second-largest export earner, the sector has struggled with environmental compliance and infrastructure bottlenecks. Shipments of leather and leathergoods have slowed due to delays in setting up the Central Effluent Treatment Plant (CETP) in Savar, said Arifur Rahman Chowdhury, general manager of ABC Footwear Industries Ltd, a concern of Abedin Group. “Without the CETP, many tanneries fail to meet global environmental standards, particularly the Leather Working Group (LWG) certification required by most European buyers,” he noted. Chowdhury added that the CETP’s completion would resolve nearly 80% of the sector’s challenges. Still, there is hope. According to the Leather Goods and Footwear Manufacturers & Exporters Association of Bangladesh (LFMEAB), 80 percent of exports go to just 10 countries—highlighting the potential for market expansion. With renewed focus on compliance and branding, leather could reclaim its place as a premium export. Frozen and Live Fish: The Blue Economy Awakens Bangladesh’s quiet revolution in aquaculture has made it a regional leader in sustainable fish farming. The country’s fisheries sector earned around half a billion US dollars in the last fiscal year, reflecting steady demand for shrimp, pangasius, and tilapia. Bangladesh Bank and the Ministry of Fisheries are working on improving traceability and certification standards. Yet, export volumes remain modest due to quality inconsistencies and limited cold-chain infrastructure. With rising global interest in clean protein and sustainable seafood, Bangladesh’s fish exports could scale rapidly—if supported by investment in logistics and branding. Empowering smallholder farmers with training, digital tools, and access to finance could unlock further growth. Strengthening community-based hatcheries and eco-friendly practices would ensure sustainability, while coordinated branding could position Bangladesh as a trusted global seafood supplier. Agricultural Commodities: A Sleeping Giant Agricultural exports brought in just over $1 billion in FY2024-25, led by fruits, vegetables, and processed foods. Mangoes, in particular, saw a rebound thanks to improved quality and packaging. However, the sector suffers from fragmented supply chains and slow policy support. Export growth has been inconsistent, and agricultural products face steep competition from regional players. The Ministry of Agriculture and EPB are now focusing on diaspora-driven demand and organic certification. Digital platforms for farm-to-market linkages, real-time price data, and quality monitoring could reduce inefficiencies and empower growers. Strategic partnerships with private investors and international buyers would further enhance competitiveness, ensuring that Bangladesh’s produce earns recognition in premium global markets and that agri-exports become a major growth engine. Pharmaceuticals: The Next Frontier Bangladesh now exports medicines to more than 160 countries after meeting 98 percent of its domestic demand, including shipments to highly regulated markets in Europe and North America. Pharmaceutical exports have nearly doubled in recent years to about $215 million, driven by WHO-compliant manufacturing facilities and competitively priced generic formulations. According to Md Zakir Hossain, secretary general of the Bangladesh Association of Pharmaceutical Industries (BAPI), exports could have easily surpassed the one-billion-dollar mark if not for a series of global setbacks, including the Covid-19 pandemic, the Ukraine–Russia war, and the ongoing devaluation of the Taka against

Read More

Energy Crisis Pushes Ceramic Industry to the Brink

Bangladesh’s ceramic industry is facing one of its toughest periods in decades, as soaring gas prices and unstable energy supply strain production and profitability. Between 2015 and 2023, gas prices in the manufacturing sector surged by about 345 percent, including a 150 percent hike in 2023 alone. This escalation has raised production costs by 18-20 percent, since gas serves as both a key energy source and raw material. Yet, producers cannot freely increase prices due to competition from cheaper imports, forcing many factories into losses. The government is now considering another 152 percent gas price hike, which could raise rates to Tk 30-75.72 per cubic meter, further lifting costs by 30-35 percent and impacting other major sectors. Unstable Gas Supply and Factory Shutdowns For ceramic producers, a consistent gas supply is vital, as the industry depends on a 24-hour flow at steady pressure—around 15 PSI—for uninterrupted kiln operation. In reality, however, gas pressure often drops to 2–3 PSI or even zero, halting production. Despite paying full rates, factories in hubs such as Savar, Dhamrai, Rupganj, Tongi, Gazipur, Narsingdi, and Mymensingh face frequent disruptions, with 20–25 units affected daily, causing losses of about Tk 20 crore and export order cancellations. BCMEA President: The Sector Is Under Severe Pressure “Currently, the country’s ceramic manufacturers are grappling with a sharp decline in sales and rising production costs amid unstable gas supply and a sluggish construction sector,” said Moynul Islam, president of the Bangladesh Ceramic Manufacturers and Exporters Association (BCMEA). He explained that gas shortages and high fuel costs have pushed production expenses up by 18-20 percent, forcing many factories to reduce output and offer deep discounts just to stay in business. “The ceramics sector is under severe pressure,” he said. Islam highlighted that the industry plays a crucial role in employment generation and foreign exchange earnings. “Lead (Pb) and Cadmium (Cd)-free tableware and affordable sanitary ware are essential for modern living. Bangladesh needs affordable tiles, tableware, sanitary ware, and ceramic bricks to meet domestic demand and support our $1 billion monthly foreign currency inflow. This prominent sector employs millions and still has scope for further investment.” “When gas supply drops, factories switch to alternative fuels, which significantly increase costs. Profit margins have shrunk, and some producers are even running at a loss,” he added. According to BCMEA estimates, sales of tiles, sanitary ware, and tableware have fallen by 15-40 percent since mid-2024. “After the fall of the Awami League government during the ‘July Uprising’ last year, the artificial economic bubble burst, weakening demand for construction materials. Many projects slowed, and the private housing market cooled. As a result, factories are operating well below capacity, with unsold goods piling up in warehouses,” said Islam. He added that the entire construction value chain—including cement, steel, and ceramics—has been affected by the broader economic slowdown. “If development projects regain momentum and gas supply stabilises, the market will gradually recover. We expect business confidence to return once these challenges are addressed,” the BCMEA president said. Energy Sector Woes Compound the Crisis Shafiqul Alam, lead energy analyst for Bangladesh at the Institute for Energy Economics and Financial Analysis (IEEFA), said all industrial sectors, including ceramics, are suffering due to energy supply disruptions or reduced supply. “Bangladesh’s growing reliance on the international fossil fuel market—now accounting for about 56 percent of total energy supply—has made the system highly vulnerable to global price shocks,” he said. Although energy efficiency has improved in industries, there is untapped potential too. Further, transmission and distribution losses in the gas sector remain significant. “Had these losses been minimized, the gas shortage facing industries could have been slightly reduced,” Shafiqul noted. He added that despite several gas price hikes at industrial levels, supply to industries remains insufficient. For the ceramics industry, he recommended improving kiln efficiency and enhancing energy efficiency in captive power generation by utilizing waste heat to cut energy use and costs. Fiscal and Policy Burdens Beyond the gas crisis, the ceramic industry faces additional challenges from import delays, high raw material costs, and steep bank interest rates. Compounding these pressures are additional duties—currently 15 percent on locally made tiles and 10 percent on sanitary ware—that make domestic products less competitive. Industry leaders argue that these duties are counterproductive, as ceramic goods are no longer luxury items but basic necessities for hygienic living. High taxes, they warn, may deprive citizens of affordable sanitation products and undermine the government’s “Sanitation for All” initiative. The BCMEA has urged policymakers to refrain from further gas price hikes for industrial users, ensure uninterrupted gas supply at stable pressure levels, and withdraw additional duties on local ceramic products. Policy and Renewable Solutions Dr. Masrur Reaz, chairman of Policy Exchange Bangladesh (PEB), believes the ceramic sector still holds “immense potential,” but supportive policies are crucial. “Despite skilled workers, a growing domestic market, and strong international demand, the industry has yet to reach its full potential due to unsupportive policies,” said Dr. Reaz. “Even with modern technology and efficient management, factories suffer daily losses when gas pressure drops or supply is disrupted. Additional duties also make local products less competitive than imports.” He urged the government to recognise the industry’s strategic role in employment, exports, and infrastructure. “Practical steps—such as halting further gas price hikes, ensuring stable supply, and reviewing duties on local tiles and sanitaryware—are essential to stabilise the sector.” Dr. Reaz also advocated renewable energy as a sustainable solution. “Installing solar panels on rooftops or open land allows ceramic manufacturers to generate their own power, reduce gas dependence, cut costs, and promote eco-friendly production.” He noted Bangladesh’s strong export potential, especially in South Asia, the Middle East, and the United States, where tariffs are more favourable. “Removing internal barriers, fostering innovation, and expanding exports can unlock the industry’s full

Read More

MADE IN BANGLADESH: Homegrown Champions of Change

Bangladesh’s meteoric rise in the global garment industry has long been admired, and now a deeper transformation is underway — one that reflects diversification, resilience, and ambition. Amid global supply chain realignments and rising manufacturing costs in East Asia, Bangladesh has emerged as one of the world’s most export-ready economies. But beyond the looms and threads, “Made in Bangladesh” businesses are stepping into the spotlight — from green technology and agribusiness to pharmaceuticals and consumer goods. It’s time the world pays closer attention to the homegrown brands proudly carrying the “Made in Bangladesh” label. The list is far from exhaustive, as Bangladesh is home to many more brands that deserve global recognition. In this special feature, we bring into focus five companies and visionaries who have not only grown with the country but have also redefined what it means to be a “Made in Bangladesh” business. From expanding beyond borders to competing with international players, their journeys reflect the spirit of a nation that refuses to be boxed in. A common thread binds them all — a relentless desire to rise despite the odds. To begin the story, there is none other than Anis Ud Dowla, the visionary chairman of ACI Group. A pioneer in every sense, Dowla represents the kind of leadership that has helped redefine the possibilities of Bangladeshi enterprise. Next comes Hossain Khaled, Chairman of City Bank. This visionary banker played a crucial role in transforming a struggling bank with weak financials into one of the top lenders in the country. From the travel and tourism field, Sadia Haque — co-founder and CEO of ShareTrip — steals the spotlight with her innovations in the sector. The full-stack travel solutions her firm offers have brought about a massive change in the tourism landscape of Bangladesh. No story on Bangladesh would be complete without mentioning Ahsan Khan Chowdhury, chairman and CEO of Pran-RFL Group — a perfect example of how a legacy can be nurtured and turned into an empire. And last but not least, Walton Hi-Tech Industries PLC — the first Bangladesh-origin company to ship electrical and electronic appliances to international markets — stands as a testament to the nation’s growing industrial prowess. Let’s explore the trailblazers behind the “Made in Bangladesh” renaissance. A Beacon of Principled Leadership In Bangladesh’s corporate history, few names command as much respect as M. Anis Ud Dowla. At a time when business and politics often converge, Dowla has carved a distinct path—one rooted in ethics, innovation, and an unwavering commitment to national progress. His career began not in boardrooms but in the field, as a young executive with British Oxygen. Over nearly three decades, he rose through the ranks, managing operations across Pakistan, Kenya, and Bangladesh. That global exposure laid the foundation for a leadership style defined by experimentation and efficiency. The defining moment came in 1992, when Imperial Chemical Industries (ICI) offered him a chance to take over its Bangladesh operations. The deal was unconventional: a “pay-as-you-earn” arrangement that required no upfront capital. Dowla accepted, and Advanced Chemical Industries (ACI) was born. “The beginning was challenging, but I made sure that no matter what, I would remain fair to my workers,” Dowla said. “I assured them that they would receive a fair share of the benefits for the efforts they were putting in. It was a 60:40 profit-sharing arrangement between the investors and workers. And it paid off.” From modest beginnings with just 352 employees, ACI has grown into one of the country’s largest conglomerates, now employing over 30,000 people across 29 subsidiaries. Its portfolio spans pharmaceuticals, consumer goods, agribusiness, and logistics. Under Dowla’s leadership, ACI became the first Bangladeshi company to earn ISO 9001 certification, setting a benchmark for quality and transparency. “I wanted to have a guardian who would ensure that there was no compromise in quality. The ISO certificate did that for me. They used to visit ACI, conduct audits, and help me produce quality products every time.” “I went for the certificate to fulfil my dream of remaining true to our customers and never deceiving anyone in any way.” Despite his success, Dowla remains grounded. His philosophy centres on values—quality, fairness, customer focus, and continuous improvement. These principles, he insists, are not slogans but lived realities within the company. Dowla’s views on politics are equally clear-cut. He believes that mixing business with political ambition undermines merit and compromises governance. “I strongly believe entrepreneurs should not enter politics, and politicians should not be entrepreneurs.” For Dowla, politics is a service, not a career path for entrepreneurs. At ACI, employees are treated as family. The ACI chairman sees leadership as a process of unlocking human potential. To young entrepreneurs, his advice is simple yet profound: pursue what you love, embrace failure as a lesson, and never settle for shortcuts. Even in his late eighties, Dowla remains active, drawing energy from ideas rather than rest. In an era of blurred boundaries and shifting values, Anis Ud Dowla stands as a beacon of principled leadership—an icon admired not just for what he built, but for how he built it. From Startup to Market Leader When Sadia Haque set out to build a travel platform, her vision was rooted in something deeper than bookings and itineraries. “We wanted a travel tech platform where everything would be shared,” said the ShareTrip CEO and Co-Founder. “Sharing of adventure, sharing of experience, sharing of laughter, and sharing of joy. And from that perspective, the name came as ShareTrip.” That philosophy of connection would go on to shape one of Bangladesh’s most successful digital ventures. Drawing on her background in telecoms, media, and technology, Haque channelled over a decade of corporate experience into a startup that would soon redefine how the country travels.

Read More

Welcome to the World of Ceramics

Once a quiet corner of the industrial map, Bangladesh’s ceramic sector has sculpted its way into the spotlight. Over the past decade, the industry has witnessed an extraordinary 150 percent surge in both production and investment, transforming it from a modest manufacturing niche into a vibrant engine of growth. It’s a milestone that marks the rise of a sector now central to the country’s architectural identity. That journey now enters a new chapter with the return of Ceramic Expo Bangladesh 2025, the flagship event of the Bangladesh Ceramic Manufacturers and Exporters Association (BCMEA). From November 27 to 30, the International Convention City Bashundhara (ICCB) in Dhaka will transform its Pushpanjali – Hall 5 into a showcase of ceramic excellence—bringing together over 136 exhibitors, 300 brands, and more than 25,000 visitors under one roof, with the support of the Export Promotion Bureau (EPB), Techna, ASEAN Ceramics, Keramika Indonesia, and Ceramic China. Now in its fourth edition, the expo has grown into one of South Asia’s most influential B2B platforms, drawing over 500 foreign delegates and participants from 25 countries. “This is Bangladesh’s only international exhibition dedicated to ceramics,” said Irfan Uddin, general secretary of BCMEA and chairman of Ceramic Expo Bangladesh. “With 31 local manufacturers and 105 global exhibitors, the expo creates unmatched opportunities for partnership, investment, and growth.” From raw materials to robotics, from sustainable kilns to smart design, the expo promises a panoramic view of what’s next in ceramic innovation. GLOBAL AND LOCAL EXHIBITORS The 2025 edition of the ceramic expo has a long list of local and foreign exhibitors. Every local ceramic company will join the show, along with international participants—most of which are raw material, machinery, or tech suppliers. Every participant of the expo has high hopes for Bangladesh’s ceramic industry. Kutubuddin Ahmed, chairman of Sheltech Ceramics Ltd, said the ceramic industry in Bangladesh is entering a new era driven by talent, quality, and a growing domestic market. “Ceramic Expo Bangladesh 2025 is the perfect platform to experience this progress.” Leading Chinese company Foshan HLT & DLT Technology Co. Ltd also believes ceramics have every potential to be the next big export earner for Bangladesh, said Marco Guan, deputy managing director of HLT & DLT and chairman of DLT, a supplier of engineering design, machinery, and technical know-how. Sacmi Imola S.C. (SALA), a global ceramic technology leader, sees Bangladesh’s strong entrepreneurial spirit and technical expertise as key to becoming a global hub. Despite challenges like energy costs, infrastructure gaps, and banking inefficiencies, local ceramic companies show resilience, long-term vision, and a focus on quality over price wars, the company said. SPONSORS Leading local ceramic company Sheltech Ceramics Ltd is the principal sponsor of this year’s Ceramic Expo, while there are three platinum sponsors: DBL Ceramics Ltd, Akij Ceramics Ltd, and Meghna Ceramic Ind. Ltd. The 2025 edition has four gold sponsors: Mir Ceramic Ind. Ltd and Abul Khair Ceramic Ind. Ltd from the local market, and Sacmi Imola S.C. (SALA) and Foshan HLT & DLT Technology Co., Ltd. from the foreign market. FOUR DAYS OF CERAMIC ACTIVITY “At Ceramic Expo Bangladesh 2025, local technicians will directly engage with global exhibitors to find real-time solutions,” said Moynul Islam, president of BCMEA. “It’s the world’s only trade fair uniting both Chinese and European ceramic giants under one roof.” Dealers’ Night One of the standout moments at Ceramic Expo Bangladesh 2025 will be the Dealers’ Night, a grand gathering designed to celebrate the people who carry the industry’s story to every corner of the country. More than just a networking event, Dealers’ Night will serve as a recognition of the sales leaders, distributors, and retail partners who bridge the gap between manufacturers and consumers. The evening will bring together over 200 dealers, sales professionals, and more than 20 industry leaders from across Bangladesh, creating a vibrant forum for exchange, collaboration, and celebration. It is here that the industry’s “deal-breakers” will share experiences, discuss market trends, and explore strategies to expand the reach of Bangladeshi ceramics both locally and globally. The BCMEA is organising the event with a clear vision: to honour the dealers and salespersons as the torchbearers of the ceramic industry. Their role is not limited to transactions; they are the storytellers who translate innovation into demand, and the ambassadors who ensure that Bangladesh-made ceramics find their way into homes, offices, and institutions. Seminars Every day at Ceramic Expo Bangladesh 2025 won’t just be about booths and business cards—it’ll be buzzing with ideas. Alongside the packed exhibition halls, multiple seminars will dive into the real issues shaping the future of Bangladesh’s ceramic industry. With over 70 manufacturers investing nearly $2 billion and more than 60,000 people directly involved, these conversations matter. From energy costs to export hurdles, topics that often go unheard will finally take center stage—thanks to open discussions between industry leaders, policymakers, and professionals. The seminars are: Energy Efficiency Strategies for Industry in Bangladesh: Challenges and Opportunities This seminar will explore how Bangladesh’s ceramic industry can adopt renewable energy, improve efficiency, and reduce costs. Experts will highlight practical solutions, policy frameworks, and global best practices to ensure sustainable growth amid rising energy challenges. Skills Development for Sustainable Growth in Industry Focused on workforce transformation, this session will examine training, technical education, and innovation-driven skill sets. Industry leaders and policymakers will discuss how nurturing talent can strengthen competitiveness, empower youth, and secure long-term sustainability for Bangladesh’s ceramic sector. Global Market Strategies: Challenges and Opportunities for Ceramic Products This seminar will analyze export diversification, branding, and competitiveness in international markets. Discussions will address trade barriers, logistics, and evolving consumer preferences, while showcasing strategies to position Bangladeshi ceramics as a global leader in quality and innovation. B2B / B2C Meetings The fair will offer ample space for B2B and B2C meetings, enabling local and global

Read More

How Bangladesh’s Interiors Got Smarter, Greener, Better

Over the past decades, Bangladesh’s interior sector has undergone a steady evolution. This progressive transformation in design trends and practices is significant across all sectors, including residential, industrial, healthcare, hospitality, retail, and commercial spaces. Rapid urbanisation, economic growth, globalisation, cultural exposure, and growing concern for sustainability are the major forces driving the interior design shift. Changing Residential Interior As urbanisation accelerates, a gradual shift in housing typology has emerged. Traditional single-storey houses and bungalows are being replaced by denser urban structures and micro-apartments, particularly in major cities such as Dhaka and Chittagong. As a result, residential units are now designed with more compact and efficient layouts. To maximise functionality, designers incorporate space-saving solutions, including wall-mounted shelving, built-in storage, and modular furniture. As plots shrink and outdoor gardens become scarce, balconies and terraces are being converted into green oases that help bring nature indoors. In terms of design styles, interior spaces now reflect greater diversity, ranging from minimalist and modern to contemporary and fusion. Collectively, these factors are redefining residential interiors as more functional, sustainable, and visually harmonious. Shift in Commercial Design In the early to mid-20th century, commercial interiors were formal and compartmentalised, with enclosed rooms and long corridors. Materials such as wood and marble were used to convey permanence and formality. By the late 20th century, the rise in corporate culture and global trends led to the emergence of open-plan layouts. Rigid walls began to be replaced by glass partitions that fostered communication and a transparent working environment. From the 2010s onward, corporate interiors started to prioritise sustainability and employee wellbeing. Concepts such as biophilic design and eco-friendly materials, including reclaimed wood and recycled components, are now being incorporated to improve air quality. The Decathlon’s Dhaka office designed by Studio One Zero, is a perfect example of a workspace that blends nature and smart design seamlessly. “What truly distinguishes the office space is its deliberate, sensitive incorporation of natural elements into an urban setting. We wanted the overall design to be meaningful and experiential” ,says Jafor Hoq, chief architect of Studio One Zero. Embracing Tech-led Designs Bangladesh’s industrial interiors—especially in RMG, tanneries, food processing, and other sectors—have drastically changed over the past 50 years. Early factories were built with tight production floors, poor lighting and ventilation, and minimal worker amenities. As industries began to rise, manufacturers moved towards vertical integration (cutting, dyeing/finishing, warehousing, R&D/sample rooms). This initiative introduced a major shift in industrial interiors; however, worker facilities remained basic. The Rana Plaza collapse in 2013 led to a surge of inspections and safety retrofits, resulting in changes to fire safety systems, marked aisles, medical rooms, and improved workstation ergonomics. New industries now increasingly integrate life-safety upgrades (fire doors, fire escape signage), clear zoning, and worker-welfare blocks (cleaner toilets, canteens, and childcare rooms). Energy-efficient LED lighting, water-saving fixtures, and other green building strategies are being adopted. According to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), the country boasts 258 LEED-certified factories, including 109 Platinum and 133 Gold-rated facilities. Institutional interiors in Bangladesh have also undergone significant transformation, shaped by both local and global design trends in architecture, technology, and educational philosophy. Earlier universities featured classic, colonial-style architecture, such as the University of Dhaka. Over time, university interiors shifted towards creating more flexible and student-centric spaces. Classrooms today are equipped with modern technologies such as multimedia projectors and smartboards. Moreover, charging stations and internet access points are being integrated into common spaces—libraries, lounges, and cafeterias. Sustainable design practices have become one of the most significant considerations over the decades. For example, BRAC University has incorporated biophilic design principles, eco-friendly materials, and energy-efficient systems. The university adopts modern colour schemes and diverse textures, along with more student-friendly amenities that promote collaboration and creativity. Hospitality and Public Spaces Blending Global Aesthetics Early hotels (during the 1960s–1980s) in Bangladesh prioritised functionality over aesthetics, often shaped by a colonial-modern architectural approach. Interior layouts were formal, with minimal ornamentation and durable finishes such as terrazzo floors and simple wooden or rattan furniture. In the 1990s–2000s, with the arrival of international brands, interiors shifted towards a contemporary design approach. Spaces became more refined, introducing upgraded amenities, grand lobbies and ballrooms, and heavy use of imported finishes and materials. A significant example of a luxury hotel is the new Sheraton Dhaka, designed by Volumezero Ltd. It features grand lobbies and banquets, lavish dining venues, and premium materials and finishes. From 2010 onwards, hotel and resort design began to blend local cultural elements with global contemporary styles. This includes the use of local craftsmanship, textiles, motifs, and artwork. Sustainable materials such as bamboo and jute, along with natural textures like wood finishes and earthy plasters, are now extensively used. Public spaces such as airports in the early period focused primarily on practicality and functionality. For example, the old Tejgaon Airport and early Hazrat Shahjalal International Airport (HSIA) featured simple layouts with limited amenities. With gradual modernisation, airport interiors began to prioritise passenger comfort. Duty-free shops, cafés, lounges, and digital flight displays have been incorporated. From the 2010s to the present, design has integrated modern efficiency with local art and aesthetics. Elements include modern amenities (digital signage, self-scanners), imported materials, and sustainable finishes. A prominent example is HSIA Terminal 3, designed by architect Rohani Baharin. The design incorporates modern minimalism and local cultural motifs, highlighting clean, light-toned finishes, large open spaces, and high vaulted ceilings with an eye-catching floral geometric motif. Natural lighting is emphasised, reducing dependence on harsh artificial lighting. Another prominent example in the transformation of public transport infrastructure is the new Cox’s Bazar Railway Station, designed by Volumezero Ltd. The transportation hub has evolved from a functional terminal into a high-end passenger experience. “We aimed to depart from the traditional notion of railway stations being merely standard

Read More

BANKS BRUISED but Still Standing Strong for Manufacturing

Bruised by inflation, foreign exchange volatility, and a surge in non-performing loans, Bangladesh’s banking sector has nonetheless held its ground — emerging as the country’s lone financial engine in a year of global and domestic disruption. With the capital market still lacklustre, banks have shouldered the full weight of financing both government and private enterprise, keeping the wheels of development turning. In 2024, the sector showed remarkable grit, navigating macroeconomic turbulence while maintaining liquidity and credit flow across industries. This resilience was not just structural — it was strategic. As investor sentiment cooled, the private sector leaned harder on banks, reaffirming their role as the backbone of Bangladesh’s economic recovery. Profits Surge as Six Banks Break Records Performance-wise, several private commercial banks surged ahead, with six institutions — BRAC Bank, Pubali Bank, Jamuna Bank, Bank Asia, Shahjalal Islami Bank, and Dhaka Bank — surpassing their entire 2024 profit figures within just the first nine months of 2025 — a testament to operational strength and depositor confidence. Combined, these banks earned Tk 7,411 crore from investments, mostly in treasury bonds — a roughly 70 percent increase from the previous year. Moreover, BRAC Bank and City Bank crossed the Tk 1,000 crore profit mark in 2024 for the first time in the country’s banking history, while others recorded their highest-ever earnings. Sustainability Ratings Reflect Governance Strength Recognizing this momentum, Bangladesh Bank named 10 banks and two non-bank financial institutions (NBFIs) as sustainable performers in its Sustainability Rating 2024. The banks include BRAC Bank, City Bank, Dutch-Bangla Bank, Eastern Bank, Jamuna Bank, Mutual Trust Bank, NCC Bank, Prime Bank, Pubali Bank, and Shahjalal Islami Bank. Among NBFIs, IDLC Finance and IPDC Finance retained their positions. These 12 institutions were evaluated across five key indicators: the sustainable finance index, CSR activities, green project financing, the core banking sustainability index, and banking services coverage. Banks with strong risk management, healthy capital adequacy, and low non-performing loans scored higher, while metrics like Tier-1 capital to risk-weighted assets, CMSME loan share, large-loan exposure, and agent banking reach added depth to the rankings. The sector also saw moderate asset growth, with total assets rising 9.65% in 2024 to Tk 26,29,775 crore — reversing declines from 2021 and 2022, according to the central bank’s Financial Stability Report. Liquidity remained sound, with the Advance-to-Deposit Ratio at 81.55% — well below the 87% ceiling — while strong deposit growth continued to fuel rising loan demand. In a year defined by uncertainty, Bangladesh’s banking sector didn’t just endure — it evolved. With sustainability, profitability, and resilience converging, it has reaffirmed its role as the country’s principal engine of financial stability and growth. Governance: The Line Between Success and Struggle “Some banks in the banking sector have performed very well, while others have done quite poorly,” said Syed Mahbubur Rahman, CEO and Managing Director of Mutual Trust Bank. “The main factor behind weak performance in some banks is governance — banks with better governance have performed better. Those where the Board of Directors interfered in day-to-day operations have not done well,” he said. On the other hand, banks that followed proper corporate governance practices have consistently performed well, and their non-performing loans have remained within limits, he added. The sluggish pace of NPL recovery has also contributed to the accumulation of NPLs. Additionally, the Russia-Ukraine war, global tensions, local currency depreciation, and other domestic economic challenges are straining business operations and reducing borrowers’ repayment capacity — further accelerating the banking sector’s NPLs in Bangladesh, according to Bangladesh Bank’s Financial Stability Report. Even though some banks have underperformed, the banking sector has made a major contribution to the economy — especially as the capital market remains small and its role in capital formation negligible, he said. The bond market is also nearly non-existent. Since independence, industrialisation, employment, and per capita income growth have been supported 80–90 percent by the banking sector, directly and indirectly, he clarified. Banks have facilitated letters of credit for trade, enabled remittance inflows, and provided refinancing during Covid-19. From agricultural loans to start-up financing, the sector has stepped in whenever funding was needed. Most CSR spending in the country also comes from banks. “The banking sector is definitely playing a significant role in overall economic activity,” he said. “The banks are contributing to sustainable finance too,” added Rahman, also a former president of the Association of Bankers, Bangladesh (ABB). Some banks are doing extraordinarily well in increasing their sustainable and green financing. Toufic Ahmad Choudhury, a former Director General (DG) of the Bangladesh Institute of Bank Management (BIBM), said that although there were high NPLs in the banking sector “under the carpet,” which were not previously disclosed, the poor health of some banks is now clear. “This is a positive sign that the problem of some banks is now diagnosed.” Most importantly, the central bank is focusing on the banking sector to ensure good governance in every bank. “It is another good sign that good governance is now being ensured across the sector,” he said. Regarding the merger of five banks, he said that if new leadership can boost public confidence and the government does not interfere unnecessarily, only then can the banks be revived. Depositor Confidence and the Road to Reform Banking sector deposits registered an average annual growth rate of 7.69 percent by the end of 2024, compared to 10.15 percent the year prior, according to Bangladesh Bank data. Deposit growth slowed mainly due to high inflation and a confidence crisis in several banks. Inflation in Bangladesh has hovered above 9 percent since May 2023, and stood at 8.36 percent in September 2025. Among asset managers who invest in bank shares and analyse their performance most closely is Mir Ariful Islam, CEO and Managing Director of Sandhani Asset Management. He said some banks saw significantly

Read More

Real Estate in Bangladesh High Potential Mounting Challenges

Bangladesh’s real estate sector stands at a defining moment. With an annual housing demand of nearly 100,000 new apartments and rapid urbanisation, the sector holds enormous promise. Yet affordability, regulatory constraints, volatile economic conditions, and weak financing continue to hold it back. As cities like Dhaka and Chattogram sprawl under population pressure, a more inclusive, well-regulated, and investor-friendly environment is crucial to unlock the sector’s full potential. Industry leaders and analysts agree that timely reforms and coordinated strategies are vital for steering real estate towards sustainable growth. A Burgeoning Market Over the past two decades, Bangladesh has seen unprecedented urbanisation, driven by rural-to-urban migration. Dhaka alone absorbs around 300,000 new residents each year, fuelling soaring demand for both residential and commercial spaces. “We developers have the capacity to meet the entire demand,” said FR Khan, managing director of Building Technology and Ideas (bti). Yet the current supply meets only about 8 percent of annual demand, revealing both opportunity and inefficiency. At the same time, housing preferences are shifting. Buyers are seeking wellness-focused, eco-friendly and community-oriented living rather than plain apartments, reflecting changing lifestyles and higher expectations. Affordability and Rising Costs Homeownership remains out of reach for most middle-income families due to high borrowing costs. Mortgage rates of 12 to 13 percent make long-term loans unaffordable, while the standard 30 percent down payment blocks many aspiring buyers. In a high-inflation economy where daily living costs keep rising, saving for such an amount is nearly impossible. “Even those with stable jobs and moderate incomes can’t commit to housing loans due to high rates and economic uncertainty,” said M Hoque Faisal, director of sales and marketing at Tropical Homes Ltd. “What we need is a subsidised loan scheme for the middle class—say, at 5 percent interest.” Most banks cater to high-net-worth clients, leaving middle-income households with limited financing options. Without tailored financial products, millions remain excluded from the housing market. Rising construction costs and land scarcity have worsened the crisis. Fluctuating exchange rates and higher VAT and customs tariffs on materials such as steel, lifts, and cement have sharply pushed up costs. The taka’s depreciation against the US dollar has further compounded the problem. Land acquisition in urban areas is also becoming prohibitively expensive. “Shortage of land is making investors pay a fortune,” said M Mahbubur Rahman, CEO of Rupayan City. These twin pressures have squeezed developer margins and pushed housing prices even higher. Economic and Political Instability Real estate is highly sensitive to broader economic and political trends. Inflation, currency instability, and election-year uncertainty have all dampened investor confidence. According to Bangladesh Bank data, outstanding construction loans fell to Tk 1.23 trillion during April–June FY2024–25, down from Tk 1.26 trillion in the previous quarter. Residential housing loans for urban buyers dropped by 3.96 percent, while infrastructure loans declined by 2.05 percent. “Banks and developers are becoming increasingly cautious,” said economist Dr Masrur Reaz. “Commercial housing has shown resilience due to higher margins, but overall lending has slowed, signalling a contraction in the sector.” The DAP Controversy The Detailed Area Plan (DAP), introduced by Rajuk in 2022, has sparked heated debate among developers. The main concern is the Floor Area Ratio (FAR), which limits how many units can be built on a plot. “While the DAP is academically sound, it doesn’t account for the dense, historic nature of Dhaka,” said FR Khan. “It’s based on planning models from low-density, developed cities.” Since the DAP’s implementation, over 200 industries connected to real estate have been affected, according to the Real Estate and Housing Association of Bangladesh (REHAB). Landowners are increasingly reluctant to offer their property for joint ventures, citing reduced profitability under stricter zoning and height limits. REHAB has formally urged the government to revise the DAP to reflect Dhaka’s ground realities and revive sectoral momentum. Market Trends and Opportunities Even as high-end housing demand cools amid declining purchasing power, the mid-market segment is expanding. Many people are investing in real estate to hedge against inflation, viewing property as a safer long-term asset. Rental yields in Dhaka and Chattogram have remained relatively stable. The sector is also a major employment driver—ranking as the country’s third-largest employer—and supports industries such as cement, steel, transport, and home electronics. In 2020, the government’s policy allowing undeclared income to flow into real estate channelled over Tk 20,000 crore into the sector, generating Tk 2,000 crore in tax revenue. Sustainability: A Growing Focus Environmental awareness is reshaping real estate practices. The Bangladesh National Building Code (BNBC) now promotes energy-efficient designs, rainwater harvesting, and sustainable materials. Green-certified buildings appeal to climate-conscious buyers and help developers access international green financing. Policy Roadmap for Reform To unlock the sector’s full potential, experts call for coordinated action between the government and private developers. Home loans must become more affordable through lower interest rates, while fixed-rate mortgage options can shield buyers from rate volatility. Raising loan-to-value ratios would let buyers borrow a greater share of property value. Bangladesh Bank could introduce targeted credit lines for first-time and middle-income buyers to expand access to financing. Registration fees and stamp duties should be reduced to encourage participation in the formal housing market. Lower VAT and import duties on materials would cut construction costs. Tax rebates or subsidies for first-time buyers, especially from middle-income brackets, would make ownership more achievable. The DAP’s FAR and zoning rules need to better reflect Dhaka’s urban density. Increasing FAR in suburban and peri-urban areas would promote growth beyond the city centre, while planning models should align with Bangladesh’s infrastructure capacity and population dynamics. Investment in satellite towns equipped with schools, hospitals, markets, and transport links would ease pressure on Dhaka and Chattogram. Strengthening inter-city connectivity and ensuring public services and job opportunities outside major cities would support balanced regional development. Licensing and

Read More

Bangladesh A Champion in Green Sustainable Manufacturing

Bangladesh’s garment industry, once marred by tragedy and global scrutiny, is now leading a quiet revolution in sustainable manufacturing. The world’s second-largest producer of readymade garments, the south Asian nation is currently home to the highest number of green factories in the world. The change did not come overnight. From being hit by twin disasters that damaged the country’s global image to emerging as a frontrunner in green production, the journey was far from smooth. From solar-powered facilities to water-saving technologies, local manufacturers have embraced environmental compliance not just to rebuild trust—but to redefine Bangladesh’s role in the global supply chain. A decade ago, in the wake of the Tazreen Fashion fire and the Rana Plaza collapse, the garment sector suffered a severe reputational blow. End consumers began chanting slogans against Bangladeshi garments, claiming the clothes were blood-stained, and started avoiding locally made apparel. As a result, both international clothing retailers and brands, as well as local manufacturers and suppliers, faced trouble as the inflow of work orders declined after the crisis. However, Western consumers’ buying behaviour was also changing at that time, as they began preferring products made with environmental protection in mind and in adherence to higher compliance standards. Retailers, brands, and local manufacturers capitalised on this green shift—primarily to restore the image of the apparel sector and, by extension, the country’s reputation among international communities and Western consumers. As part of this strategy, local manufacturers began greening their production facilities to convince Western consumers that Bangladesh adheres to international compliance standards in the garment trade. Moreover, there was pressure from international communities to reduce carbon emissions. Consequently, factories were built following guidelines from the US Green Building Council (USGBC), the body that certifies Leadership in Energy and Environmental Design (LEED) for environmental sustainability. Within a short span of time, Bangladesh saw the establishment of 263 LEED-certified factories, of which 111 are Platinum rated, 133 Gold, 15 Silver, and four Certified. The best part is that Bangladesh boasts 68 of the world’s top 100 highest-rated LEED-certified factories. Almost all top LEED-certified apparel manufacturing units are located in Bangladesh—a milestone that testifies to the vision and resilience of the country’s apparel entrepreneurs. This is not all. Over 500 more factories are currently awaiting certification from the USGBC. By investing in green buildings and sustainable practices, manufacturers are not only reducing environmental impact but also enhancing efficiency, cutting costs, and strengthening Bangladesh’s reputation as a responsible and forward-looking sourcing destination. Their commitment ensures that the industry remains globally competitive. Fazlee Shamim Ehsan runs one of the greenest garment factories in the world. He is the managing director of Narayanganj-based Fatullah Apparels Limited, which earned LEED Platinum certification from the USGBC with a score of 97 out of 110—one of the highest ever awarded globally in the apparel sector. Ehsan said: “Local manufacturers began building green garment factories primarily to improve the image of the sector and the country. Environmental protection has also become a crucial part of the global supply chain, particularly in reducing carbon emissions,” he added. “Manufacturers are not only greening their factories but also adopting new technologies. By greening their factories, they can reduce underground water consumption by 40 percent and save 35 to 40 percent in electricity costs,” Ehsan said. “Manufacturers also preserve rainwater through harvesting systems, using it primarily for flushing toilets.” According to Ananta Ahmed, managing director of 360 Total Solution Limited (360TSL), a sustainable development consultancy company, some Platinum-rated LEED garment factories can reduce carbon emissions by up to 70 percent. This means that if a normal factory emits 100 megatonnes of carbon, a specially built Platinum factory emits only 30 megatonnes, he said. It is even possible to achieve net-zero carbon emissions by installing new technologies and adopting innovative practices. However, average-rated garment factories typically reduce emissions by 30 to 40 percent. Garment factories are now using solar panels, as required by Western buyers, which reduces dependence on fossil fuels and provides natural lighting, significantly cutting carbon emissions, he said. Do green factories cost more to build than regular ones? Many assume green garment factories are costlier to build, but they are actually more economical and yield higher long-term profits, said Ananta Ahmed, also a faculty member of the US Green Building Council (USGBC). Construction costs are roughly 10 percent lower than those of conventional factories, he noted. In Bangladesh, green factories also enjoy a reduced corporate tax rate of 10 percent, compared to 12 percent for non-green facilities. Profitability is significantly higher. Studies show that while a conventional factory may earn Tk 50 crore, a green facility can generate up to Tk 100 crore—thanks to savings on water and electricity, tax incentives, and a steady flow of work orders from international buyers. Buyers tend to prioritise green-certified facilities when placing orders, as end consumers increasingly prefer sustainably produced goods. Green factories may not command higher prices, but they attract more orders and are crucial for meeting European Union (EU) environmental regulations—now a key condition for sourcing from Bangladesh. Mahmud Hasan Khan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said buyers are not offering higher prices for green factories, but they are prioritising automation, sustainability, energy efficiency, water conservation, and recycling. These factors, he noted, are driving indirect gains for the industry by attracting more work orders. Adoption of New Technologies To cut water use in washing and dyeing, many factories have recently adopted advanced technologies. According to studies by the International Finance Corporation’s PaCT programme, over 338 Bangladeshi factories have reduced freshwater consumption by 25 million cubic metres annually, while slashing wastewater discharge by 21.08 million cubic metres. A decade ago, washing one kilogram of denim required nearly 200 litres of underground water. Today, that has dropped to 50 to 53 litres.

Read More

Top 5 Lifestyle Brands in Bangladesh

The fashion scene in Bangladesh has truly blossomed over the last decade. Not too long ago, Bangladeshi shoppers used to depend heavily on India or Pakistan to find fashionable clothes. But, in the recent years, there has been a rapid change in Bangladesh fashion realm. The country now boasts a thriving fashion industry, characterised by creativity, high-quality fabrics, and brands that genuinely understand local style. We’ve always had the famous stretch of markets opposite Dhaka College — a go-to spot for bargain hunters, but anyone who’s been there knows it takes time, patience, and a bit of luck to find the really good stuff. For many working people, that’s just not an option. They want something stylish, something that stands out, without having to dig through piles of clothes. Luckily, several Bangladeshi brands have stepped up to make that possible. In this world where everyone prioritizes sustainability and wants their products to last longer, given the price point, here are five local brands that are absolutely worth swiping your card for, as they assure quality products and longevity. YELLOW Yellow, under the Beximco Group, started in 2004, has built a loyal following over the last decade. Their biggest strength is quality; you can literally feel the difference in their fabric and stitching. They don’t just mass-produce clothes; each design looks thought-out and on-trend. Their collections cater to men, women, and kids, offering everything from formal shirts and trousers to dresses, polos, and casual wear. Their style leans more towards modern and minimal, perfect for people who like clean, smart looks without too much fuss. Balancing comfort and style is a universal challenge for fashion brands, and in Bangladesh’s tropical climate, it’s even more essential. Over time, Yellow has established clear comfort benchmarks tailored to each season. In Summer, Yellow favors breathable fabrics like cotton and linen, while in Winter, we turn to warmer materials such as wool, fleece, and corduroy. Each garment undergoes multiple testing phases, including wear tests and internal group reviews, to ensure that comfort is never compromised. Yellow also has a great range of shoes, bags, belts, and accessories. Their eyewear line has quietly gained popularity, too. Whether you’re shopping for work-wear or something for the weekend, Yellow’s designs are reliable, stylish, and long-lasting. SAILOR Sailor came into the picture in 2015 and has built quite a name in just ten years. Their collections feel fresh, colourful, and very wearable, perfect for people who like both western styles and deshi touches. They’ve got something for everyone: men, women, and kids. You’ll find everything from t-shirts and jeans to kurtis, panjabis, and festive outfits. What makes Sailor fun is how they mix comfort with creativity. You can go from casual Friday to weekend hangouts without needing a wardrobe change. And it’s not just about clothes, as they’ve got shoes, handbags, backpacks, and even small lifestyle bits like grooming items. Sailor has become one of those go-to brands where you can easily pick a whole look without hopping from store to store. AARONG There’s really no way to talk about Bangladeshi fashion without mentioning Aarong. Started in 1978 under BRAC, Aarong has been part of so many homes and celebrations that it’s practically a household name. From timeless sharis to beautifully crafted panjabis and kurtis, Aarong has always represented classic Bangladeshi craftsmanship. Over the years, they’ve expanded far beyond traditional wear. Their western and fusion collections now appeal to a wide range of customers, from university students to professionals. The versatility in their collections makes it easy to dress for both festive occasions and everyday wear. And let’s not forget everything else Aarong offers — jewellery, shoes, handbags, and a beautiful range of home décor and crafts. Their Aarong Earth line has skincare and lifestyle products made with natural ingredients, which have become a favourite for many. Aarong is not just a clothing brand; it’s a full experience. RANG BANGLADESH Since 1994, Rang Bangladesh has been spreading colors across the nation—bright, lively, and full of the energy that mirrors our culture. Their collections are not just clothes; they are stories woven in threads, celebrating the rhythm of Bangladesh’s festivals and traditions. From Sharee, Panjabi dresses to matching outfits, statement jewellery and handicraft, every piece reflects a cheerful spirit. Some outlets even carry small home items, keeping that colorful essence alive in every corner of life. Rang Bangladesh designs and creates a wide range of theme-based and festival-inspired outfits. Each festival comes with its own special collection. Every design reflects a sense of originality, beautifully expressing time, tradition, and emotion through thoughtful themes. What truly sets Rang Bangladesh apart is how it captures the festive Bengali spirit in wearable, everyday pieces. Whether it’s Pohela Boishakh, Eid, Durga Puja, Lalon Utsab, Winter, the Season of Spring, Valentine’s Day, Victory Day, Nazrul or Rabindranath special collections, or simply a day you want to brighten up, there’s always something to match your mood. JATRA Jatra, founded in 2000 by artist and musician Anusheh Anadil, was created to celebrate and revive Bangladesh’s rich folk arts and crafts. Over the years, Jatra has become a vibrant platform showcasing the country’s culture through art, fashion, and lifestyle products. Since its inception, the brand has designed, promoted, and popularized handwoven clothing and handmade products, emphasizing sustainability and community empowerment. “Jatra has its own line of products, and we also provide a platform for successful online businesses. This allows customers to find eco-friendly and reliable products all in one place,” said Imtenaan Mohammad Jaquie, CEO of Jatra. The brand also offers customized products where customers can design their own product. This personalized approach rightly aligns with Jatra’s vision of

Read More

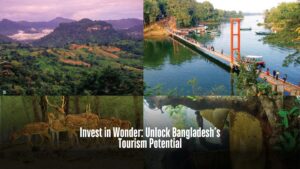

Invest in Wonder: Unlock Bangladesh’s Tourism Potential

In a country that ranks as the eighth most populous in the world, both opportunities and challenges in the tourism sector are rising exponentially. While popular destinations often experience near-zero vacancy during holidays, many other locations still require significant development and promotion to comprehend their full potential and generate substantial revenue. Globally, the travel and tourism sector contributed $10.9 trillion, or 10% of global GDP, in 2024. It is projected to reach $16 trillion—11.4% of global GDP by 2034, marking an unprecedented decade of growth and presenting a $16 trillion opportunity for nations like Bangladesh. This global boom calls for a crucial opportunity for Bangladesh, to transform its natural landscapes, coastlines, and cultural heritage into sustainable tourism assets that drive growth, generate jobs, and strengthen the economy. That being said, here are a few travel destinations in Bangladesh, each poised for significant growth: Cox’s Bazar Beach Loved by both domestic and international travelers, Cox’s Bazar—home to the world’s longest uninterrupted natural sea beach remains a go to tourists’ destination. Whether it’s a leisurely drive along the marine Drive, hunting for authentic local goods, strolling under the moonlit shore, savouring fresh seafood, or simply escaping the nine-to-five grind, Cox’s Bazar offers something for everyone. In the social media era, now more travel enthusiasts are discovering its full potential. Ongoing development and upgrades of international-standard hotels, resorts, and specialized eco-retreats, particularly in hotspots like Cox’s Bazar, are set to expand opportunities for a diverse range of visitors. Its ultimate challenge, however, lies in implementing a sustainable master plan that promotes economic growth while protecting the fragile environment and safeguarding the well-being of its diverse communities. The Sundarbans As global demand for ecotourism rises, the Sundarbans holds immense potential to become a flagship destination that blends conservation with community empowerment. This UNESCO World Heritage Site offers serene landscapes, golden sunsets, and the rare glow of bioluminescent plankton, making it a truly world-class destination in waiting. Its network of waterways presents a unique chance to generate significant financial returns while serving the global public good. Comfortable resorts in Khulna provide ideal bases for travellers to relax while experiencing the region’s exceptional ambiance. The Sundarbans is a global Blue Carbon hub, absorbing carbon faster than any land forest. By promoting eco-friendly lodges, safe walkways, and guided wildlife tours, visitors can experience its unique beauty without damaging one such valuable global asset. Empowering local communities and ensuring they share in tourism benefits will make every visit meaningful not only for the travellers but also for the people and pulse of Sundarbans. Kuakata Kuakata is one of the few places in Bangladesh where one can witness both sunrise and sunset over the sea, offering breathtaking vistas for Instagrammers and nature lovers. Unlike Cox’s Bazar, its beaches are relatively less crowded, providing a more peaceful coastal experience. The area is also a significant hub for the Indigenous Rakhine community, who settled here after being expelled from Arakan (Myanmar) in the 18th century. The adjacent forests and secluded beaches are home to diverse bird species and natural phenomena like Red Crab Island (Kakra Dwip), where thousands of bright red crabs emerge at low tide, creating a stunning visual spectacle. The inauguration of the Padma Bridge in 2022 drastically reduced travel time from the capital, Dhaka, making Kuakata significantly more accessible and fuelling a rise in domestic tourism. With growing potential for quality accommodations, infrastructure, and adventure services, it is emerging as a promising alternative to Cox’s Bazar. Keokradong ‘‘Nothing can beat Bandarban’’—that’s how people often describe their favorite tourist destination in Bangladesh.” It’s picturesque, wild, and untouched—an experience that makes visitors want to return here again and again. Often called the “roof of Bangladesh,” Bandarban is home to the country’s highest peaks, including Tahjindong (Bijoy), Mowdok Mual, and Keokradong. Its cloud-kissed mountains, dense forests, winding rivers like the Sangu, tranquil lakes, and numerous waterfalls make it a paradise for nature lovers. While the road infrastructure has significantly improved, high-quality accommodations for guests remain limited. Current constraints including infrastructure, quality lodging, and adventure services—should not be seen as roadblocks, but rather as clear market signals for innovative developers to help this stunning destination reach its full potential. Rangamati For those seeking the true ethnic flavors of Bangladesh, Rangamati is the answer. As the administrative heart of the Chittagong Hill Tracts and home to diverse indigenous communities, it offers rich cultural experiences and a unique dimension to tourism. Known as the “Lake City,” Rangamati is surrounded by lush hills and hosts Bangladesh’s largest artificial lake, Kaptai. Its scenic boat rides allow visitors to explore tranquil waters and islands, while notable sites such as Rajban Vihara, a prominent Buddhist monastery, attract travelers for their religious and architectural significance. The region’s indigenous communities are also celebrated for their handwoven textiles, offering beautifully crafted souvenirs at local markets. For the adventurous, Rangamati presents exciting trekking routes along its picturesque hill trails. By actively involving local communities in planning and management, the region can ensure that economic benefits are equitably shared while preserving its cultural and environmental heritage for generations to come. Muktagacha Jamidar Bari The Muktagacha Zamindar Bari in Mymensingh is a magnificent, though perhaps less-discussed, testament to Bangladesh’s rich architectural and cultural heritage. This historic estate, once home to affluent landlords, offers a window into the country’s aristocratic past, showcasing classic colonial-era architecture, intricate woodwork, and expansive courtyards. Despite its dilapidated state, the Bari holds a strong appeal for niche visitors. While many artifacts have found homes elsewhere, such as at Shashi Lodge, it is the crumbling grandeur, the silent courtyards, and the weathered walls that define its haunting beauty. For history enthusiasts, the site is a deeply atmospheric landmark where the past feels almost tangible. Preserving the legacy of Muktagacha Zamindar Bari and transforming it into a prominent heritage

Read More